Apple introduces savings account in the US – Times of India

After introducing a credit card and buy-now-pay-later service, Apple also has a savings bank account for Card users in the US, with a 4.15 per cent annual interest – 10 times the average interest rate in the US.

Apple has partnered with Goldman Sachs once again for the savings account. There are no minimum balance requirements, no minimum deposits, and no fees. Users can set up their savings account from Apple Card in Wallet and start by saving their daily rewards.

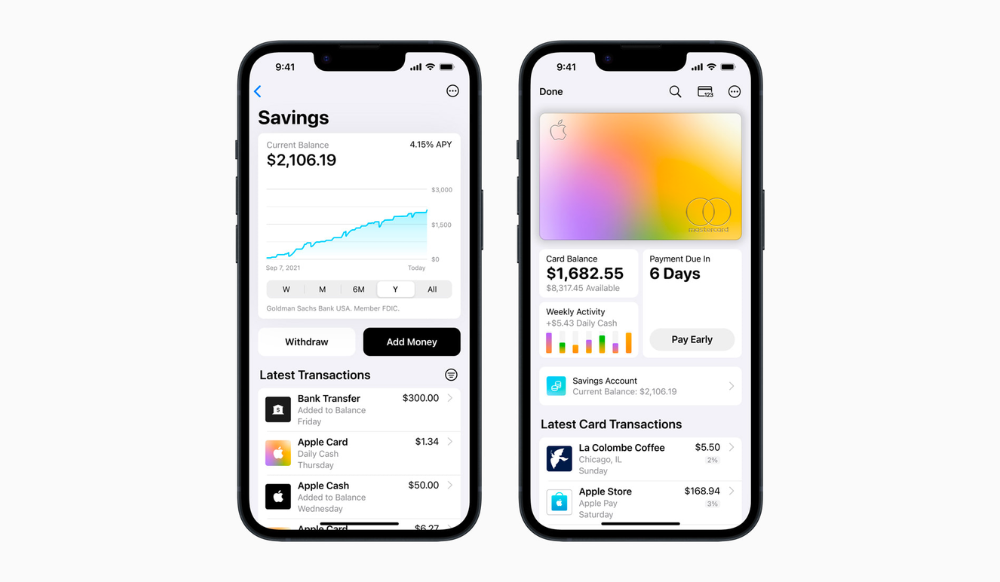

Apple Card offers cash back rewards for purchases, with default rates of 1% for all purchases, 2% for Apple Pay purchases, and 3% for select merchants.

The cash rewards are deposited into Apple Cash, which functions like a checking account in the Wallet app and can be used for various transactions. Once users set up their savings account, Apple Card’s daily rewards will go into their savings accounts, providing a convenient way to save money. Users can also manually add funds to their Apple Card savings account from the linked bank account or Apple Cash balance.

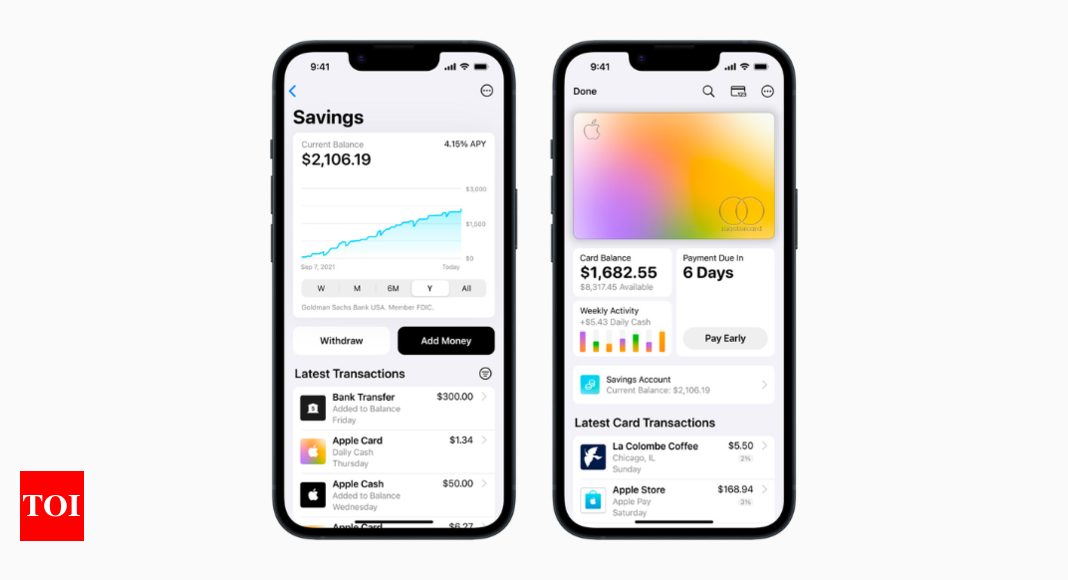

The Wallet app provides access to the savings account where users can view their current balance, check the current interest rate, and review recent transactions. Users can also manually deposit or withdraw money from this screen. The savings account balance can be transferred to Apple Cash or a regular bank account as needed.

While there are no minimum balance requirements, the maximum balance limit is $250,000.

“Savings helps our users get even more value out of their favourite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet.

She added, “Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

Apple has partnered with Goldman Sachs once again for the savings account. There are no minimum balance requirements, no minimum deposits, and no fees. Users can set up their savings account from Apple Card in Wallet and start by saving their daily rewards.

Apple Card offers cash back rewards for purchases, with default rates of 1% for all purchases, 2% for Apple Pay purchases, and 3% for select merchants.

The cash rewards are deposited into Apple Cash, which functions like a checking account in the Wallet app and can be used for various transactions. Once users set up their savings account, Apple Card’s daily rewards will go into their savings accounts, providing a convenient way to save money. Users can also manually add funds to their Apple Card savings account from the linked bank account or Apple Cash balance.

The Wallet app provides access to the savings account where users can view their current balance, check the current interest rate, and review recent transactions. Users can also manually deposit or withdraw money from this screen. The savings account balance can be transferred to Apple Cash or a regular bank account as needed.

While there are no minimum balance requirements, the maximum balance limit is $250,000.

“Savings helps our users get even more value out of their favourite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet.

She added, “Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

Apple BKC in Mumbai: A Sneak Peek of Apple’s Mumbai store

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.

Denial of responsibility! NewsUpdate is an automatic aggregator around the global media. All the content are available free on Internet. We have just arranged it in one platform for educational purpose only. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials on our website, please contact us by email – [email protected]. The content will be deleted within 24 hours.