Deloitte: Some, but not all, chip shortages will ease in the second half of 2022

The shortage has helped cement semiconductors as an essential industry on par with food and energy production, Deloitte said, but it isn’t structured to support that criticality.

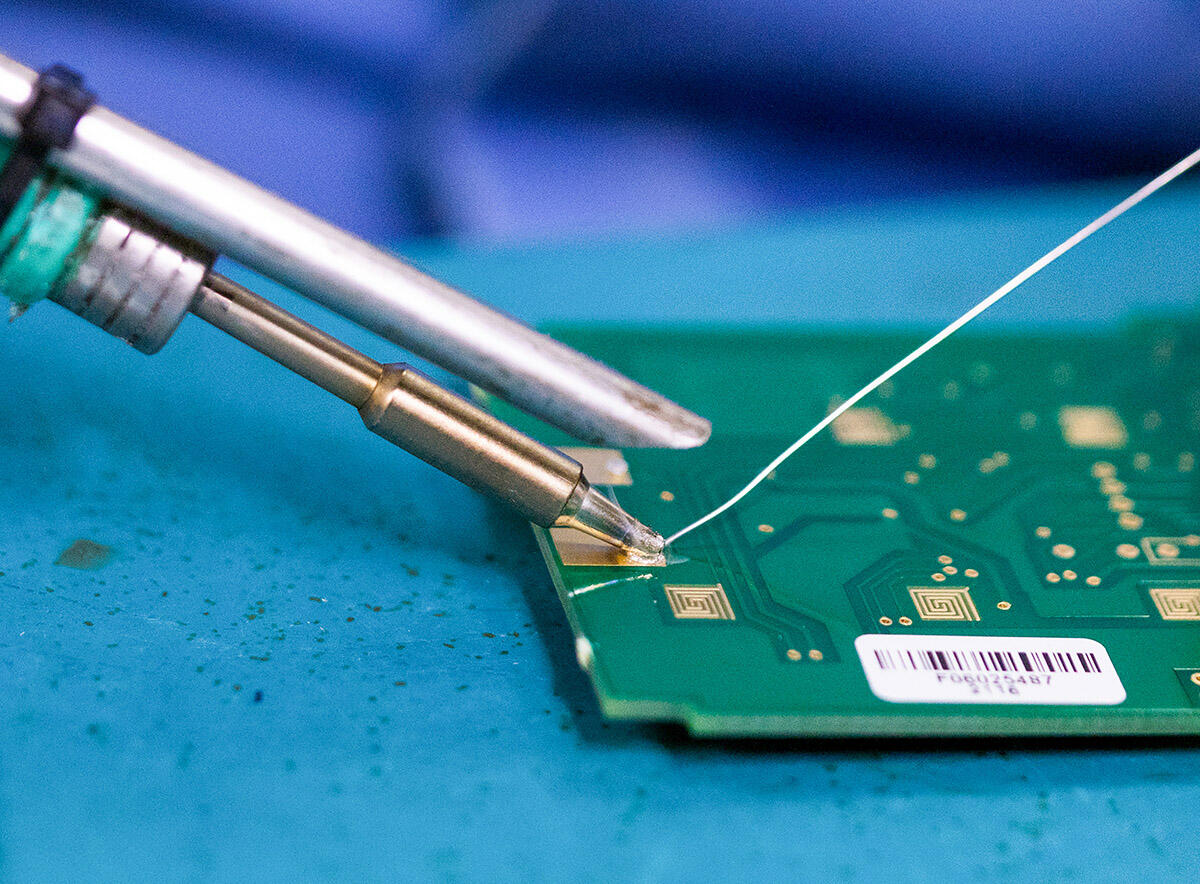

Image: Chris Ratcliffe/Bloomberg/Getty Images

Deloitte’s semiconductor industry outlook report for 2022 leads with a big claim: The semiconductor industry is just as essential to our modern world as food, energy, logistics and other fundamentals.

Despite its essential nature, which Deloitte said was made clear thanks to the ongoing chip shortage, the semiconductor industry isn’t structured in a way that reflects that. Deloitte readily admits that the semiconductor industry is dwarfed by the size of the agricultural, oil and gas sectors, “80% of the world’s food or fuel doesn’t come from a handful of manufacturers concentrated in just a few countries.”

SEE: Google Workspace vs. Microsoft 365: A side-by-side analysis w/checklist (TechRepublic Premium)

“Across multiple end markets, the absence of a single critical chip, often costing less than a dollar, can prevent the sale of a device worth tens of thousands of dollars,” the report said, adding that the shortage of the past two years resulted in revenue shortfalls more than $500 billion worldwide.

It’s with that in mind that Deloitte made four big predictions for the semiconductor industry in 2022, with all coming down to one word: Disruption. Yes, it’s an overused term, but it definitely applies to the semiconductor industry right now.

1. Semiconductors: The shortage continues

Let’s address that elephant in the room: Yes, the shortage is going to continue, but it won’t be as bad as last year, Deloitte said.

“We expect the severity and duration of the chip shortage, and its economic ramifications, to be less pronounced because of increased capacity, but also from supply chain improvements that chipmakers, distributors and end customers make,” the report said.

Don’t expect the shortage to abate immediately: Production is still ramping up in new facilities (many of which won’t open until 2023), and it’s going to take at least the first half of 2022 for some semblance of normalcy to return. Also, that’s only for some industries.

Those industries that don’t catch up will probably end up waiting until 2023 for their problems to abate, with Deloitte warning that it may be “well into 2023” before components with longer lead times can be expected to begin flowing normally.

2. There’s a people shortage in the semiconductor industry

Like everyone else, the semiconductor industry hasn’t been spared the effects of the Great Resignation—Deloitte said that the semiconductor industry has felt it even worse, for four reasons:

- Chip manufacturer revenues will be almost 50% higher in 2022 than in 2019.

- Recent growth of the semiconductor industry in Taiwan and South Korea has exhausted the existing talent pool.

- Localized chip production will open up additional talent pools, but not in the short term because new talent will still have to learn new skills.

- The job skills needed in the semiconductor industry are changing, with increasing reliance on software skills, and it’ll take time to hire all the right people.

In short, industry growth and transformation happening as a direct result of the shortage is faced with another shortage: Qualified people. With shortages everywhere, it might take even more time to fill roles essential to operations.

3. Chip manufacturing will begin to localize

Deloitte said it expects global wafer starts to be 50% higher by the end of 2023 than in 2020, and while a lot of that will be in traditional semiconductor strongholds of Taiwan and South Korea, not all of it will.

“Increasingly, [new fabs] will be in the United States, China, Japan, Singapore, Israel and Europe—a trend known as “localization”—increasing chip production closer to the next step in the supply chain,” The report said.

SEE: Top keyboard shortcuts you need to know (free PDF) (TechRepublic)

Deloitte said that this change is going to be difficult, but the chip shortage proved the necessity of manufacturing chips closer to their intended destination. Deloitte said semiconductor manufacturing localization could reduce risk, create new jobs and eliminate concerns over trade embargoes and global disputes. With chip manufacturing now as essential as farming, it seems like localization is a necessity.

4. Chip makers will accelerate digital transformation

Deloitte has written about digital transformation in the semiconductor industry before, and it comes down to the fact that chip manufacturers have traditionally been rigid, slow to adapt and unwilling to change.

“If semiconductor companies are to strengthen their competitive edge, they should be the first to launch new products, rapidly scale production and focus on innovation and efficiency,” the report said. Deloitte noted that half of semiconductor companies surveyed for the study linked in the previous paragraph have yet to modify their digital transformation strategy to adapt to the disruptions of COVID-19 and the chip shortage.

Deloitte said now is the time for chip industry executives to address the fallouts of the past couple of years and use that to build a new vision with a clearly outlined strategy. After all, with the rapid growth and new “essential industry” status, the next chip shortage is just around the corner.

Also see

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.