Upi: India links UPI with Singapore’s PayNow: What PM Modi said, who will benefit and more – Times of India

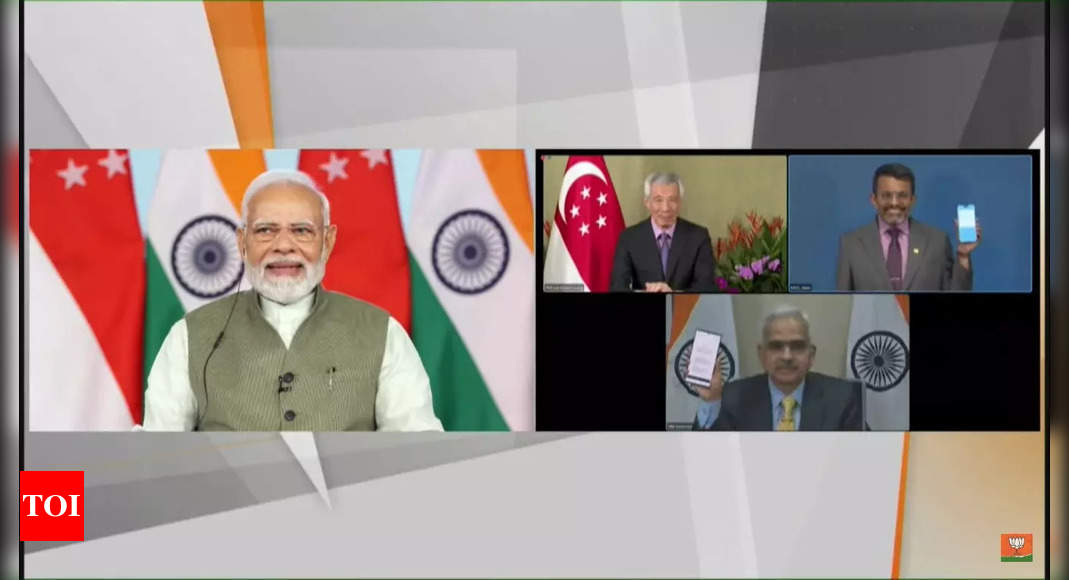

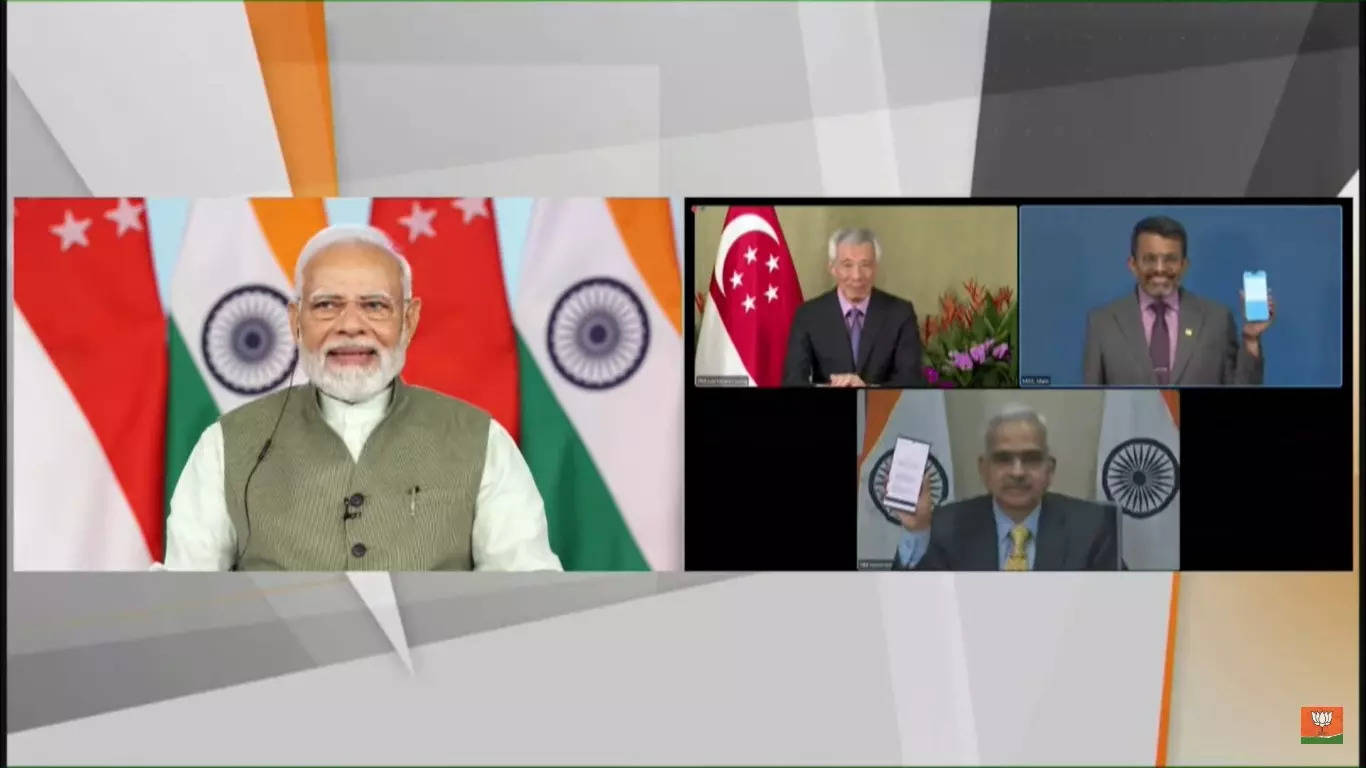

The linkage between the systems was announced by the Reserve Bank of India (RBI) Governor Shaktikanta Das and the Monetary Authority of Singapore’s (MAS) Managing Director Ravi Menon in the presence of Prime Minister Narendra Modi and his Singapore counterpart Lee Hsien Loong.

New milestone: PM Modi

After the launch, Prime Minister Narendra Modi said in a virtual conference that the linkage is a new milestone in relations between the countries.

A new milestone in India-Singapore relations as we link real-time digital payments systems. ???????? ???????? https://t.co/SubBSNyMO8

— Narendra Modi (@narendramodi) 1676958089000

“In today’s era, technology connects us in several ways. Fintech is a sector that connects people to each other. Normally, it is confined within the boundaries of one country. But today’s launch has started a new chapter of cross-border Fintech connectivity,” Modi said.

Modi also said there were approximately 74 billion transactions amounting to more than Rs 126 trillion done through UPI in 2022.

“UPI is the most preferred payment mechanism in India. Many experts are estimating that digital wallet transactions are going to soon overtake cash transactions,” the Prime Minister added.

India and Singapore announced to link their payments systems in 2021 and originally, the two nations set a deadline of July 2022 to go live with the collaboration.

Singapore Prime Minister Lee Hsien Loong said that the PayNow-UPI linkage is India’s first cross-border, real-time system linkage and Singapore’s second.

“The PayNow-UPI linkage is the world’s first such linkage featuring cloud-based infrastructure and participation by non-bank financial institutions. As we progressively add more users and use cases, the PayNow and UPI linkage will grow in utility and contribute more to facilitating our trade and our people to people links,” said Lee.

Banks collaborating in cross-border transfer

A total of eight banks, including DBS, Liquid Group, Axis Bank and State Bank of India from India and Singapore will participate in the collaboration. For now, Indians can remit up to SDG 1,000 (around Rs 62,000) a day, the RBI said.

What apps can be used to transfer money

Indians can use apps like Google Pay, Paytm and other similar digital payment systems to make low-cost and fast cross-border transfers to people in Singapore.

Who will benefit from collaboration

The UPI-PayNow linkage will help the Indian diaspora, including migrant workers and students, in Singapore to quickly transfer money from Singapore to India and the other way around.

As per the ministry of external affairs (MEA) document Population of Overseas Indians (2022), there are approximately 6.5 lakh non-resident Indians (NRIs) and persons of Indian origin currently residing in Singapore.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.