The report further adds that the smartphone market in India which includes both smartphones and feature phones declined by 15% year over year. The feature phone market registered a decline of 24% YoY due to adverse macroeconomic conditions continuing to impact the bottom-of-the-pyramid users. On the other hand, Apple led the premium segment, followed by Samsung and OnePlus.

Reasons for the decline in Indian smartphone shipments

As per the Counterpoint report, the pent-up demand during Q3,2021 and the lower consumer demand in the entry-tier and budget segments in Q3,2022 are the reasons behind the decline. “Almost all the brands were impacted, especially in the entry-tier and budget segments. The unfavourable macroeconomic conditions will continue to affect the Indian smartphone market in Q4 2022 as well, especially after Diwali,” adds the report.

How the smartphone companies performed

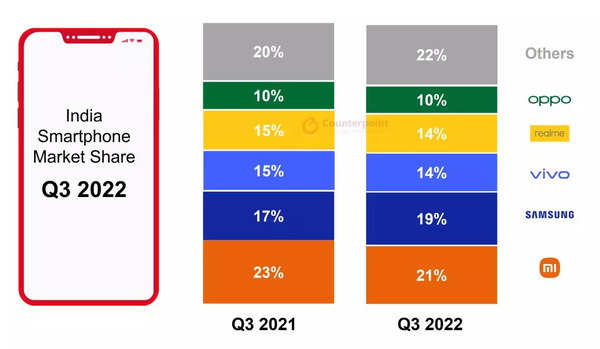

Xiaomi led the Indian smartphone market in the third quarter. The company witnessed a 19% decline in shipments due to weak consumer demand in the entry tier. However, the new launches during the quarter in the budget and mid-tier segments drove Xiaomi’s shipments.

The second position was captured by Samsung. Samsung led the handset (feature phone + smartphone) market as well with an 18% share. It also remained the top-selling 5G smartphone brand in India.

Chinese smartphone maker Vivo saw a 15% decline and captured the third position. The company managed to gain the third spot by revamping the V series and increasing its online presence with iQOO and its T-series of smartphones during the quarter.

Realme and Oppo grabbed the fourth and fifth positions within the market. Realme captured 14% market share. On the other hand, Oppo is consistently increasing its shipments in the high-tier segments. With the Reno 8 Pro, the brand made its re-entry into the ultra-premium segment (>INR 45,000).

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.